Transform Financial Services with Expert-Led Fintech App Development

From AI-powered insights to secure digital transactions, we help fintech brands build products that lead the market. Whether you're launching a mobile-first neobank or modernizing legacy infrastructure, our team delivers performance, precision, and regulatory confidence.

We partner with both startups and top fintech companies to create secure, scalable, and intuitive platforms - from payments to wealth management.

Trreta - Your Fintech Software Development Company

We don’t just build apps. We build trust, infrastructure, and future-ready financial systems. As a leading fintech software development company, Trreta specializes in creating secure, compliant, and high-performing digital products for the financial industry.

From real-time transaction platforms to AI-driven financial analytics, we combine deep fintech domain knowledge with world-class engineering. Whether you're an early-stage startup or an enterprise looking to modernize, we help you move fast, without cutting corners.

Every solution we build is guided by one principle: build it as if millions will rely on it.

Fintech Software Development Services Tailored for You

We build solutions that simplify financial operations, not complicate them. Here's how we help fintech brands innovate with confidence:

Custom Fintech Software Development

We design platforms that align with your regulatory, transactional, and operational needs. From digital lending systems to wealth management software, every build is crafted for precision, compliance, and performance. You get tech that scales with your roadmap, not off-the-shelf shortcuts.

Mobile Fintech App Development

We develop sleek, secure, and high-performance fintech apps across Android, iOS, and web. Whether you’re launching a neobank or an insurance platform, we prioritize real-time sync, fast onboarding, and native-level experiences. Think fast, frictionless finance in your users’ hands.

AI-Powered Financial Analytics

Make smarter, faster decisions with AI in fintech. We build analytics engines that predict churn, detect fraud, score credit, and drive personalization. From data lakes to dashboards, we turn complex numbers into business intelligence you can act on.

Secure Payment Gateway Integration

Accept payments globally, securely, and at scale. We integrate with Stripe, Razorpay, Plaid, and others, ensuring PCI-DSS compliance and smooth multi-currency support. Whether you're managing subscriptions or one-time payments, your platform stays bulletproof.

KYC/AML Compliance & User Verification

Speed up customer onboarding without compromising security. We build verification workflows using OCR, biometrics, and ID APIs, with support for global compliance needs. From first login to risk flagging, everything runs seamlessly in the background.

Post-Launch Support & Feature Upgrades

We don’t disappear after deployment. Our support includes bug fixes, infrastructure optimization, and roadmap-based versioning. You get fast response times, strategic improvements, and feature rollouts that match evolving market needs.

Our Fintech Tech Stack & AI Capabilities

Frontend

Backend

AI in Fintech

Security & Compliance

DevOps/Cloud

How We Build High-Performance Fintech Apps

Our approach is designed to move fast, stay compliant, and build fintech products that scale confidently.

Discovery & Compliance Strategy

We start by understanding your product vision, user goals, and regulatory environment. From market positioning to GDPR and PCI-DSS planning, this stage lays the groundwork for a friction-free build.

UI/UX Design for Fintech Interfaces

Every screen we design is built for clarity, conversion, and compliance. From onboarding flows to portfolio dashboards, our design approach keeps users engaged and confident at every click.

Agile Fintech App Development

We code in sprints and ship often. With clean documentation, dev staging, and sprint reviews, you’ll always know where the product stands and what’s coming next.

Testing, Audit & Risk Checks

Security and performance are non-negotiables in fintech. We run penetration tests, failover checks, and compliance audits to make sure your app is robust, resilient, and regulation-ready.

Deployment & Infrastructure Setup

We handle CI/CD, version control, and scalable cloud architecture — whether on AWS, Azure, or your preferred stack. You get fintech apps that perform under pressure and grow on demand.

Post-Launch Optimization

Once live, we monitor usage patterns, error logs, and user behavior to improve continuously. From A/B tests to new feature rollouts, we help you evolve with the market.

Industry Use Cases We Serve in Fintech

We partner with financial innovators across domains, from digital banking to insurtech, to build

fintech solutions that deliver speed, security, and scalability.

Digital Banking & Neo-Banking Platforms

- Online account creation & KYC workflows

- Virtual card issuance & spending insights

- Core banking integration & mobile wallet support

Lending & Credit Scoring Systems

- AI-based credit scoring using alternative data

- Loan origination, approval, and disbursement systems

- Repayment tracking, notifications, and risk management

Wealth Management & Personal Finance Apps

- Investment tracking with real-time portfolio analytics

- Robo-advisory and retirement planning features

- Personalized savings tools & user financial dashboards

Insurance Tech & Claims Automation

- Digital policy management and onboarding

- Automated claim filing, scoring, and payout logic

- Integration with CRMs and regulatory reporting modules

Payment Processing & Wallet Apps

- Multi-currency digital wallets and QR payments

- PCI-compliant payment gateway integration

- Recurring billing and invoicing systems

Investment, Trading & Crypto Platforms

- Real-time trading with performance dashboards

- Crypto wallet integration and exchange APIs

- User-level analytics and AI-driven trade suggestions

Why We’re Trusted by the Best Fintech Companies?

You have options. But here’s why leading brands trust us to build their fintech apps and platforms:

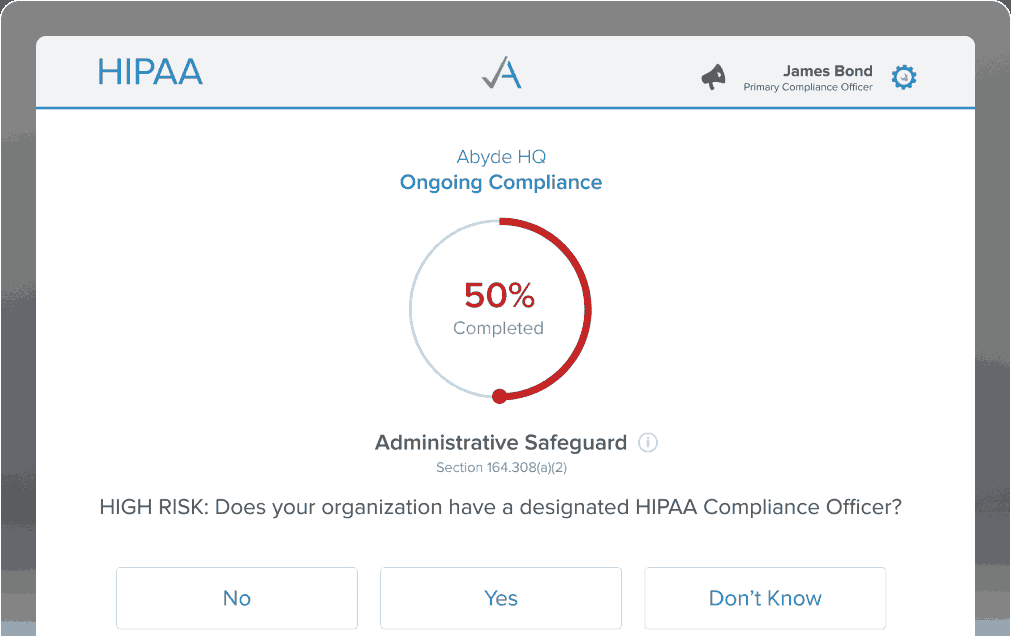

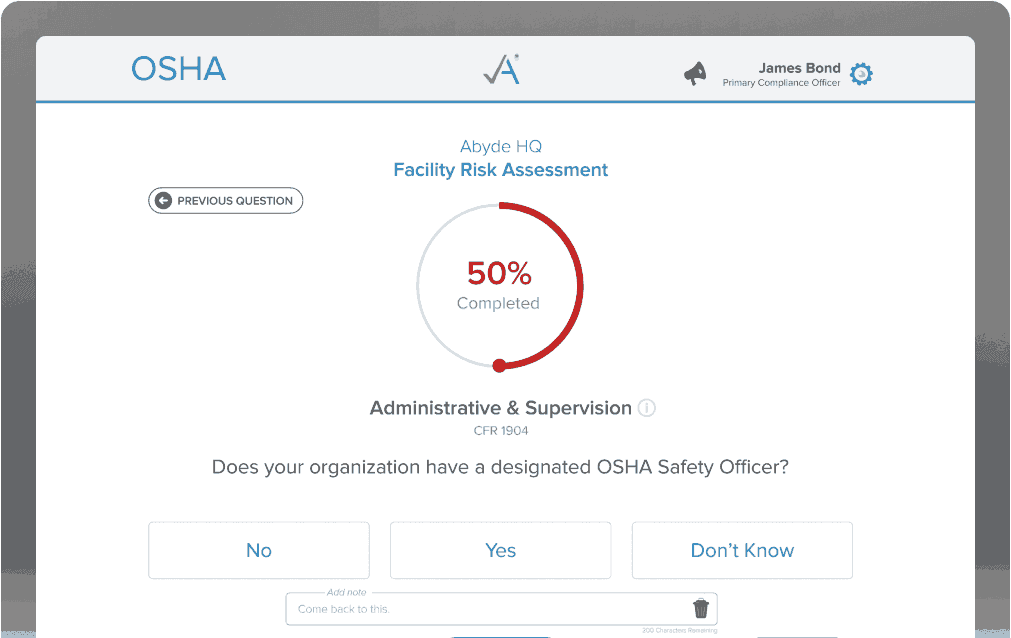

Experience with Top Fintech Regulations & Markets

We build for global compliance from day one - including PCI-DSS, SOC 2, GDPR, and RBI/SEBI guidelines. Whether you're targeting the US, EU, or APAC, we’ve got regulatory strategy covered.

Scalable Architecture for High-Volume Transactions

From trading to wallets and neobanks, we design infrastructure that handles millions of transactions with zero friction. Speed, security, and uptime, without compromise.

Deep Expertise in AI and Fintech Integration

We don’t just add AI - we make it useful. From fraud detection and credit scoring to smart portfolio recommendations, we deliver AI in fintech that drives smarter outcomes.

Transparent, Collaborative Development Process

Clear roadmaps. Weekly demos. Shared Slack channels. You’re always in the loop, from discovery to deployment - no guesswork, no surprises.

Security-First Approach Backed by Compliance

Every product we build is hardened for risk. Encryption, audit logs, MFA, role-based access, and secure APIs are built-in, not bolted on later.